Mo payroll calculator

So for someone who is full-time making 11 an hour on a biweekly pay schedule the calculation. Currently there are three tax brackets in Kansas that depend on your income level.

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

The results are broken up into three sections.

. Missouri Hourly Paycheck Calculator Results. Well do the math for youall you need to do is enter. Just enter the wages tax withholdings and other information required.

Get Started With ADP Payroll. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Missouri Income Tax Calculator Calculate your federal Missouri income taxes Updated for 2022 tax year on Aug 31 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Simply enter their federal and state W-4 information as. Use this Missouri gross pay calculator to gross up wages based on net pay. Employers can use the calculator rather than manually looking up.

If youre single married and filing separately or a head of a household you. This free easy to use payroll calculator will calculate your take home pay. Ad Process Payroll Faster Easier With ADP Payroll.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Ad Compare This Years Top 5 Free Payroll Software. Paycheck Results is your gross pay and specific.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. Free Unbiased Reviews Top Picks. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Supports hourly salary income and multiple pay frequencies. Get Started With ADP Payroll. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions.

So the Missouri minimum hourly wage rate is 1125 which translates to 8920 per day 44600 per week at 40 work hours 193267 per month. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. Its a progressive income tax meaning the more.

Missouri Salary Paycheck Calculator. Withhold 62 of each employees taxable wages until they earn gross pay. For example if an employee receives 500 in take-home pay this calculator can be.

Below are your Missouri salary paycheck results. Ad Process Payroll Faster Easier With ADP Payroll. The results are broken up into three sections.

Ad Compare This Years Top 5 Free Payroll Software. Employers can use the calculator rather than manually looking up. Your manual payroll calculations are based on the pay frequency and their hourly wage.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. So the tax year 2022 will start from July 01 2021 to June 30 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Additions to Tax and Interest Calculator. Free Unbiased Reviews Top Picks. The Missouri Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Missouri State.

Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Rules for calculating payroll taxes. Below are your Missouri salary paycheck results.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. Missouri charges a state sales tax of just 1225 on groceries Those reduced rates however do not apply to prepared food as you would purchase at a restaurant or. Minimum Wage in Missouri.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Missouri. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Missouri.

Payroll Tax Calculator For Employers Gusto

Missouri Paycheck Calculator Smartasset

Calculating Payroll For Employees Everything Employers Need To Know

Dynamics Gp U S Payroll Dynamics Gp Microsoft Docs

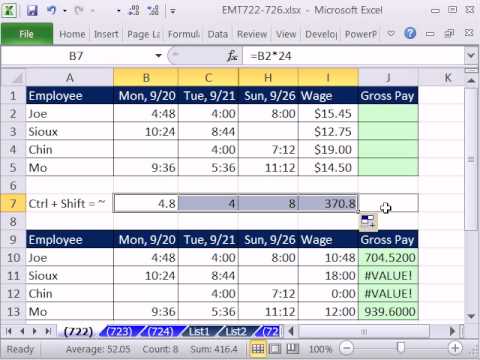

How To Do Payroll In Excel In 7 Steps Free Template

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Software Solution For Missouri Small Business

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Banner Concept Of Salary Payment To Employee Paycheck Wages For Work Vector Landing Page With Isometric Illustration Of People Handshake Money Calculator Calendar And Report Stock Vector Image Art

Payroll Software Solution For Missouri Small Business

Payroll Banner Concept Of Salary Payment To Employee Paycheck Wages For Work Vector Landing Page With Isometric Illustration Of People Handshake Money Calculator Calendar And Report Stock Vector Image Art

Is Standardization The Solution To Payroll Complexity Benefitspro

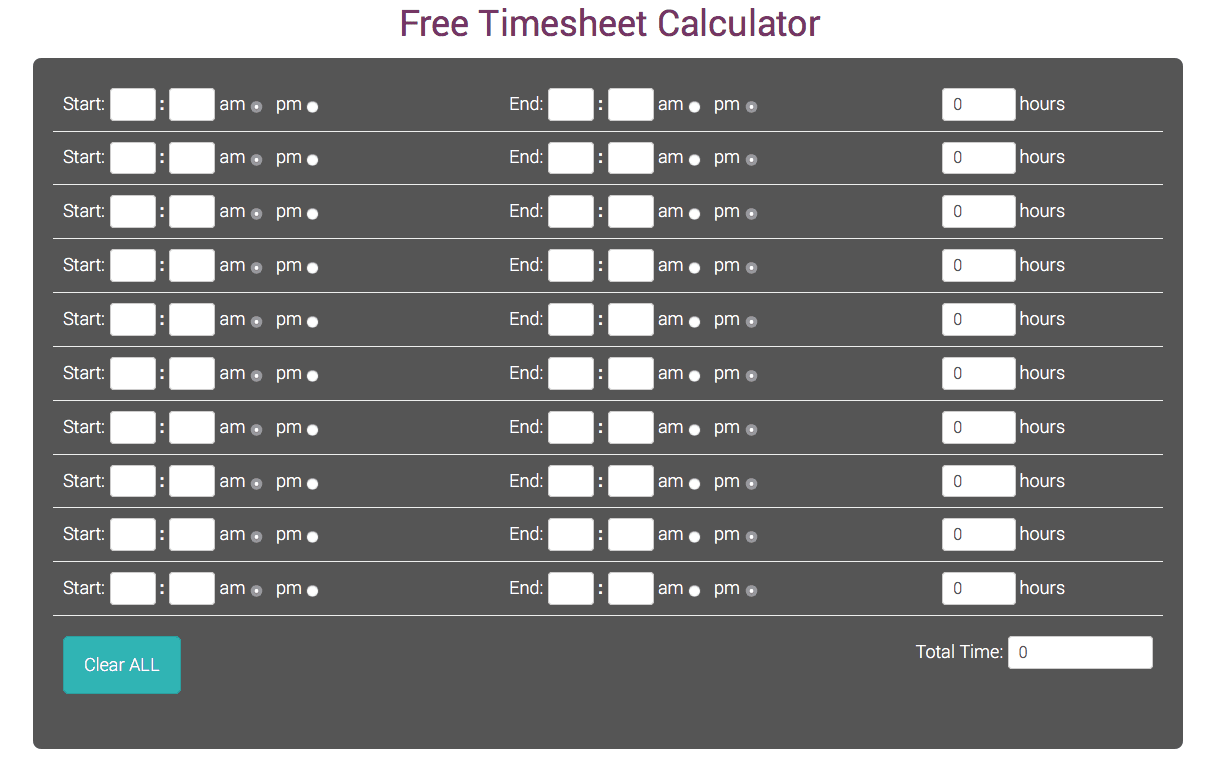

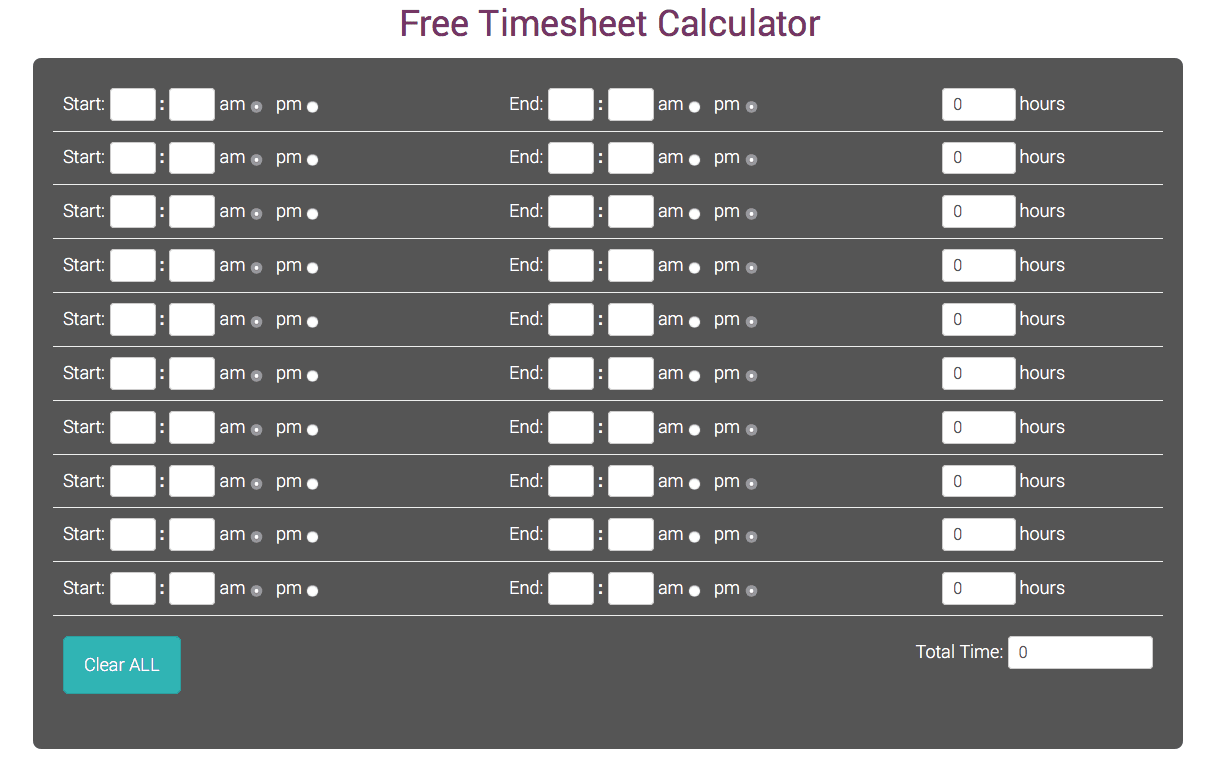

Payroll Hours Calculator Store 54 Off Www Wtashows Com

Payroll Banner Concept Of Salary Payment To Employee Paycheck Wages For Work Vector Landing Page With Isometric Illustration Of People Handshake Stock Vector Image Art Alamy

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Hours Calculator Store 54 Off Www Wtashows Com

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay